80% of Amazon advertisers plan to increase budgets in 2019

Our survey indicates 44 percent of Amazon advertisers plan to add automation tools for campaign management in the coming year.

NEW YORK – While recent quarterly earnings statements show Amazon’s advertising business is growing, a new survey by Third Door Media, the parent company of Marketing Land, Search Engine Land and MarTech Today, found that 80 percent of Amazon advertisers plan to increase spending with the platform in the coming year.

For our Amazon Advertising Forecast 2019, released Thursday at SMX East in New York City, we surveyed 681 marketers in August and found that nearly half of the respondents are currently advertising with Amazon’s search, display, video and/or programmatic offerings.

What stood out from the report is the amount of runway still ahead for Amazon advertising in terms of growing advertiser adoption, investment and development.

Where will rising budgets will come from? Of those advertising, 37 percent said they currently spend up to 10 percent of their annual digital advertising budgets on Amazon. Another 24 percent said Amazon accounts for 10 to 25 percent of their annual ad spend. Meanwhile, a small percentage — just over 10 percent — are spending 50 to 100 percent of their budgets on Amazon, meaning it’s their primary advertising channel.

Among the 80 percent who said they plan to increase Amazon advertising budgets in 2019, 20 percent plan to increase their Amazon budgets by 50 percent or more.

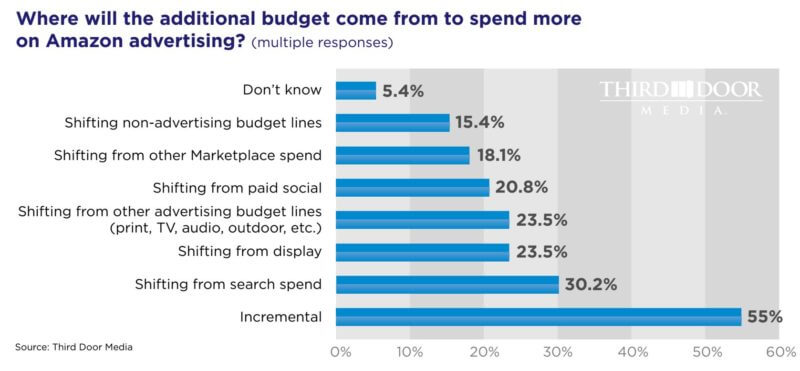

More than half (55 percent) said at least some additional budget will come from incremental sources. However, just over 30 percent said budget increases will shift from traditional search advertising, and 23.5 percent said budgets will shift from display or other non-digital budget lines such as print or TV. Nearly 21 percent said they’ll move budget from paid social, and 18 percent said it will come from ad spend on other marketplaces.

Who is managing Amazon advertising? We know many agencies have been building Amazon practice areas — or acquiring them in the case of Elite SEM recently buying CPC Strategy in large part for its Amazon advertising capabilities. Nearly 28 percent of respondents who advertise said they outsource their Amazon advertising to an agency or consultant.

There are opportunities for practitioners as well. Just over 24 percent said they have an in-house Amazon marketer or team established to manage Amazon advertising campaigns. Paid search practitioners are also poised to expand their skillsets. Nearly 22 percent of advertisers said their Amazon campaigns are managed by an in-house paid search marketer or team.

How many plan to use automation? Asked if they are using any tools or platforms to help automate Amazon campaign management, 22.5 percent said they currently use tools. Another 44.4 percent said they plan to within the next 12 months. That spells opportunity for paid media management tools and platforms that currently or plan to support Amazon.

What ad products are advertisers buying? The report also covers what products across Amazon’s advertising suite advertisers are currently using. Not surprisingly, Amazon’s pay-per-click product search ads (previously categorized under the Amazon Marketing Services brand) are by far the most popular offerings, with 86.5 percent of those advertising using the Sponsored Products, Headline Search Ads (now called Sponsored Brands) and/or Sponsored Display ads.

However, 58 percent of advertisers are running display and/or video ads across the formats formerly categorized under the Amazon Media Group brand, and 50 percent are using both AMS and AMG formats.

Just over 30 percent of advertisers said they use Amazon’s programmatic offering, formerly named Amazon Advertising Platform (AAP) and now called Amazon DSP. In September, Amazon rebranded its advertising brands under the single entity of Amazon Advertising.

Why it matters. Amazon’s product search ad inventory has proliferated on its marketplace over the past few years, but the company also has offerings beyond those tailored to marketplace sellers, with display and video inventory on its owned and operated properties as well as a DSP to programmatically target Amazon audiences on and off Amazon properties.

Amazon is in a distant third place behind Google and Facebook in terms of digital advertising market share. Yet with its rich purchase intent and history data, its growing position as the primary destination for product search, its deep pockets and its enthusiastic advertisers, Amazon is on a path to challenge the duopoly. Its ad business is also presenting an opportunity for agencies, practitioners and tool providers.