How digital commerce marketing is reshaping search, marketplaces and social

Marketing executives from Procter & Gamble and Under Armour talked SEO, customer experience, and the influence of D2C.

This rebirth is driven by retailers that, seeing the monumental growth of Amazon, are seeking out richer ways to integrate and monetize their own first-party shopper data. Walmart Marketplace is one example, as is Microsoft’s acquisition of PromoteIQ which powers sponsored product ads that can be attributed to in-store and online sales among other capabilities for retailers like Kroger. First-party data is powerful – and is enabling brands to own direct, one-on-one relationships with consumers.

Marvin also highlighted how social commerce and shoppable media are changing how we market and think about channel strategies. Ad formats (including Story ads and YouTube video ads) are increasingly becoming shoppable, allowing users to click to shop. Direct-to-consumer (D2C) brands, Marvin noted, helped prove the value of these formats.

The SMX West event, which is programmed by Marvin and other Search Engine Land experts, this year paid special attention to digital commerce marketing, a growing marketing discipline given the rise of e-commerce.

Marvin shared new data from a Marketing Land survey of Amazon advertisers found that 81% plan to increase spend on Amazon ads this year. More than half (53%) said they plan to use incremental budget to fund those increases. But while Amazon’s ad business is growing rapidly – up 40% year-over-year, reaching $14 billion at the end of 2019 – we can’t forget that Google’s ad revenues during the same period were 10 times larger than Amazon’s.

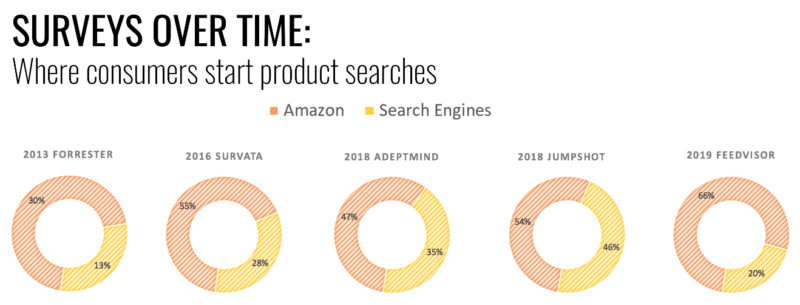

Still, Google is losing out to Amazon in terms of how consumers begin their product searches. Survey data over time consistently shows that a majority of initial product searches begin on Amazon:

Benjamin Spiegel, chief digital officer of Procter & Gamble Beauty, and Dana Tan, senior manager of global SEO for Under Armour joined Marvin on stage to dig even deeper into digital commerce marketing in 2020.

Here are a few takeaways:

Retailer sites are missing out on giving users “elevated” experiences. “The experience on e-commerce sites is almost all the same,” said Tan. You go to a site, see a grid page, there’s nothing remarkably different about that.

“We talk about elevated experiences a lot – when we go into stores, we’re looking for an elevated experience. Online, we’re looking to get in and out. How does that translate to online elevated experiences?” she asked.

E-commerce enablement. New tools and capabilities are also making it easier for retailers in every vertical to drive e-commerce sales outside of their native properties. From Google Shopping actions to Instagram’s checkout-enabled media, advanced e-commerce capabilities are taking the friction out of online checkout by shortening the steps between discovery and purchase. The new Google Shopping experience, for example, predominantly features merchants participating in Google Merchant Actions, and bears a striking similarity to Amazon’s interface, including the “buy box” that enables users to “Buy on Google.”

Designing experiences with personalization in mind. When done well, Dana Tan noted, “personalization is very effective. When done poorly, it’s creepy. I have to remind [designers and developers] that search engines are an experience and you have to design for that experience as well.”

In a D2C capacity, Spiegel explained, personalization is much more straightforward – which is why D2C brands that own the entire sales funnel are available to deliver personalization that is “more linear and personalized based on the customer’s linear journey.”

D2C as a market research strategy. The D2C model in marketing, Spiegel said, is enabling traditional CPG brands to trial launch new products and gather insights faster and cheaper. Ultimately, testing with social shopping capabilities “allows us to be more agile and nimble.” He added, “From there, we can learn a lot and scale it. What is the price we need to pay to educate a consumer on this benefit?”

Understanding the actions taken in a D2C test can provide brands with rich, first-party insights that can inform larger commerce campaign strategies. As Spiegel noted, “When it comes to D2C it’s about what can we learn. Did they buy it? Did they repurchase? And how does SEO fit into those discussions?”

Using social to drive top-of-funnel intent. Spiegel explained that social channels can be especially impactful for discovery and inspiration, but may not always be the conversion point for sales – especially for CPG (consumer packaged goods) retail. Brands must recognize this, and create content that supports the customer’s place in the buying journey.

For example, Spiegel noted, “Instagram is great for inspiration, but it might not be the best for learning.” Digital commerce brands should be thinking about where their consumer is on the journey, and use those insights to deliver high-value content suited to that channel, in that moment of the funnel.

Omnichannel: Connecting online and offline. Search engine results pages are proof of how digital is driving in-store foot traffic and offline sales. For example, buy online, pickup in-store (BOPIS) saw a 50% increase in revenue last holiday, according to Adobe.

Structured data and feeds. Merchants need to be prioritizing structured data and feeds for both paid and organic visibility, Marvin said. Google is increasingly looking at product markup and feeds to power visual search experiences — and not just for ads. The relatively new organic Popular Products section in mobile search results is an example of this.