Semrush plans to go public after posting big 2020 growth

But the company says changes in access to third-party data and cookies could really disrupt its business.

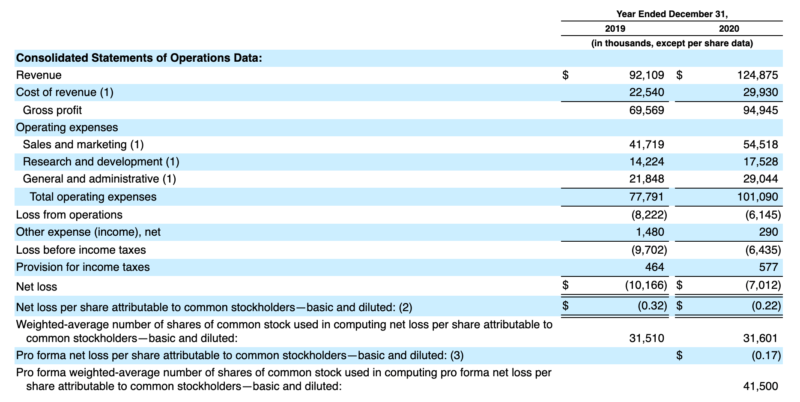

The numbers. The Form S-1 statement shows the numbers behind the SEO tool platform. In 2020 the company had just under $125 million in revenues, which was up from $92 million in 2019. The gross profit was just under $95 million in 2020, compared to just under $70 million in 2019. Semrush spends a lot on marketing, spending $54.5 million in 2020 and $41.7 million in 2019. This lead to a $7 million net loss in 2020 and a $10 million net loss in 2019.

About half of its revenue comes from U.S. customers.

The company did take in funding of $40M in 2018.

Customers. Semrush said it had 67,000 paying customers in 2020, up from over 54,000 in 2019. Keep in mind, in 2010 the company had just surpassed 1,000 customers, and in 2015 it broke the 15,000 customer mark. On the other hand, the company said it had 404,312 active free customers in 2020.

The company also said it has served over 300,000 students and has issued over 130,000 certificates all-time through its Semrush Academy, an online learning platform.

Here is a chart in the filings that shows annual subscription revenue by cohort:

Concerns. The company listed its risks factors, here are some of what they listed:

- “Our business and operating results will be harmed if our paying customers do not upgrade their premium subscriptions or if they fail to purchase additional products.”

- “If we fail to attract new potential customers through unpaid and paid marketing efforts, register them for trials, and convert them into paying customers, our operating results would be harmed.”

- “The market in which we operate is intensely competitive, and if we do not compete effectively, our ability to attract and retain free and paying customers could be harmed, which would negatively impact our business and operating results.”

- “Our products depend on publicly available and paid third-party data sources, and, if we lose access to data provided by such data sources or the terms and conditions on which we obtain such access become less favorable, our business could suffer.”

- “Changes by search engines, social networking sites, and other third-party services to their underlying technology configurations or policies regarding the use of their platforms and/or technologies for commercial purposes, including anti-spam policies, may limit the efficacy of certain of our products, tools, and add-ons and as a result, our business may suffer.”

Other products. The company said it has more than 50 tools in its ecosystem and that it intends to continue adding to its portfolio through acquisitions. The company most recently bought Prowly, a PR service, in September.

Competitive insight. Rand Fishkin, the founder of Moz and former CEO who left the company in 2018, shared his thoughts on this news. There are few who know the space like him. He said it is “really impressive what they’ve done the last 6 years. Semrush went from 3rd/4th place in SEO software, to a clear #1 in revenue & growth rate. Ahrefs is #2 at ~$55-75M, with Moz in 3rd (~$45M)* at a slower growth rate (after leading for years prior).” He did note these are guesses at the other company numbers but his guesses would be better than most.

Why we care. Many of our readers use Semrush in their day-to-day profession. This gives us a look under the hood at the company and lets us see how the platform has expanded over the years and any risks to future growth. If you are a marketer using its free tools, this also shows how important it is for Semrush to convert you into a paid subscriber. Lastly, the growth in 2020 is also an indicator of the extent that marketers have embraced search marketing during the COVID-19 pandemic.